Skrevet af Frederik Kromann 30/9-2022

Digitalisering – Undgå fejl i dit bogholderi

Du er direktør i en større virksomhed og ved at du skal stå på mål overfor investorer og bestyrelse. Dine tal skal sidde lige i skabet – ellers kommer du til at ligne en idiot.

Det er allerede sket alt for mange gange – og du har forsøgt at snakke med din bogholder om kvaliteten i arbejdet. Du forsøger at fortælle om digitale løsninger , og ikke fordi du ved hvad det skal være for nogen eller hvordan de skal anvendes. Du ved bare at noget skal der gøres. Og digitalisering er jo på alles læber.

Du har sikkert også læst lidt om den nye bogføringslov og igen er der endnu en årsag til at gøre noget ved tingene.

Du er på vej ind i vækst eller måske det modsatte – uanset er det på tide at få styr på tropperne og din økonomifunktion. Du har overvejet at du måske har brug for en regnskabschef/controller for du magter ikke at sidde med budgetopfølgning og rapportering længere.

Derudover så ved du at de tal som du får ikke er valide, så du ender nærmest med også at skulle agere bogholder. Desværre har du mere brug for forecast på likviditet end at lege bogholder – men det ene kan ikke laves uden at der er styr på det andet.

Det er klart at vi syns at outsourcing af bogholderi er vejen frem i hverfald i et vist omfang.

3 ting du skal gøre – og også en prioritering i rækkefølge så du ved hvor du skal sætte ind først.

Vi har set det alt for mange gange – en økonomifunktion er for spinkel og opgaven kan virke uoverskuelig. Heldigvis har vi stor erfaring med at spænde det kvalitetsnet ud under dit bogholderi så du kan sove roligt om natten.

Kvalitetssikring i dit bogholderi og hele din regnskabsfunktion

Udover at din bank skal stemme så skal resten af dit bogholderi selvfølgelig også. En god indikator på, om der er styr på det, er antallet af efterposteringer fra din revisor i forbindelse med årsafslutningen. Er der mere en blot selskabsskatten så er det ofte et udtryk for at der ikke er styr på kvaliteten i dit bogholderi.

Når vi kvalitetssikrer en månedsafslutning er der en laaang række checkpunkter. Du får lige et par af dem.

- Stemmer din skattekonto – det er meget rart at vide om der er gæld til SKAT

- stemmer bogført løn til lønsystem og eindkomst – det kan være at din lønbogføring og dermed dit resultat er helt forkert

- Sandsynliggørelse af moms – igen skal tingene være bogført korrekt og den rigtige moms skal være trukket.

- Gennemlæsning af kontokort – det er den nemmeste løsning for at sikre at ting er bogført korrekt

- Afskriv og periodiser månedligt – dette er IKKE en revisoropgave og bør gøres hver måned så dit resultat er retvisende

- Spær perioder – det er intet værre end at sidde med en månedsrapport og så er tidliger månedstal blevet ændret.

- Afstem samtlige balanceposter – der er ingen vej udenom. Din bogholder SKAL vide hvad der er på samtlige balanceposter og hvorfor. Dette skal gøres hver måned, selvom det tager mega lang tid.

Digitalisering af dit bogholderi – men du slår dig

Når du at fået sikret din kvalitet i bogholderiet så er du klar til næste skridt på vejen. Nemlig et effektivt digitalt bogholderi.

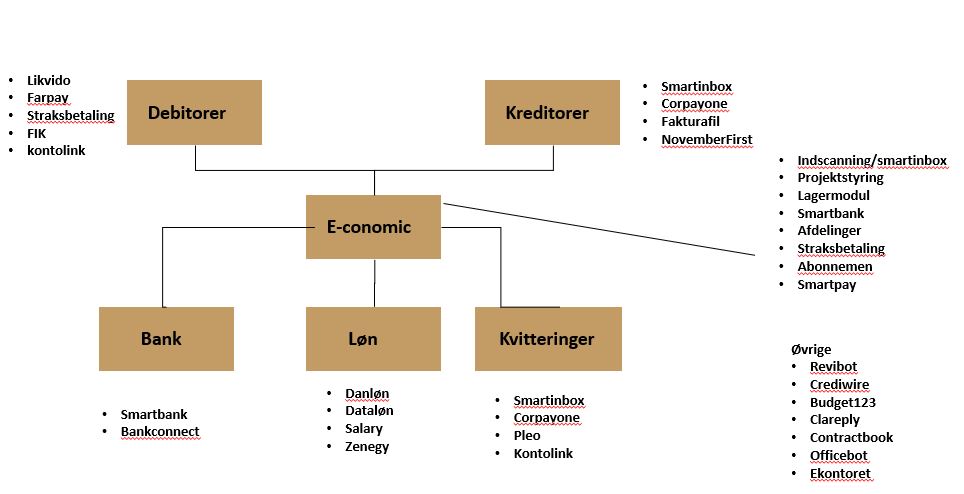

Vi har lavet en lille model over de mest populære værktøjer til digitalisering og hvordan de hænger sammen. Start med at læse lidt om Corpayone eller pleo– der er også andre værktøjer som kan være relevante.

Der er mange værktøjer som samlet set giver mening for din virksomhed, og nogle skal du skynde dig at få sat igang i en fart og andre kan godt vente lidt.

Men uanset så vil det altid give mening at komme hele paletten rundt og sætte delene sammen til det perfekte digitale bogholderi som er tilpasset netop din virksomhed.

Uddannelse

Parallelt med at kvaliteten sikres og digitalisering implementeres er det vigtigt at din interne bogholder føler sig klædt på til opgaven.

Det kan være vanskeligt at finde præcis de kurser som passer til det niveau som din bogholder befinder sig på. En decideret bogholderi uddannelse findes ikke rigtig.

Derfor har vi faktisk lavet en løsning for at imødekomme dette. Vi kalder det for masterclass i digitaliseret bogholderi.

Det er et abonnement hvor du har mulighed for at vælge mellem flere forskellige niveauer. Hovedfokus er på kvalitet og digitalisering.

Fælles for dem alle er at din bogholder får adgang til professionelle ressourcer som har specialiseret sig i at optimere og drive effektive og digitale bogholderier.

Samtidig er vi løbende med på sidelinien og sørger for at du får de digitale værktøjer implementeret og forankret i præcis den rækkefølge og på den måde som passer til virksomheden og medarbejderne.

I vores masterclass har din bogholder mulighed for sidemandsoplæring og månedlige møder hvor tingene snakkes igennem.

Derudover også løbende telefonsupport både på e-conomic men også alle de digitale værktøjer som er implementeret. Dvs at der kun er 1 kontaktperson til alle løsninger istedet for mail, chat og telefon til 5-6 forskellige udbydere af software.

FAQ:

Hvad er et bogholderi? Det er her alle dine registreringer skal være.

Hvor meget tjener en bogholder? Det kommer an på kvalifikationer og erfaring. Men bogholder løn ligger på mellem 25.000 til 50.000 pr måned.

Hvad kræver det at være bogholder? Erfaring, erfaring og erfaring

Hvad er forskellen på bogholderi og regnskab? Bogholderi er der du registrerer tingene i dit regnskab

Hvad er bogholderi? Det er den afdeling som sørger for at registrere alle jeres bilag

Hvad laver et bogholderi? De sørger for dit regnskab er opdateret og korrekt